Call Today +1 (888) 860-5167

Wait: 0 minutes | Available: 13 agents

Call Today +1 (888) 860-5167

Wait: 0 minutes | Available: 13 agents

Your information will not be distributed

Credit card processing fees can be a significant cost for business owners, especially for small businesses. By encouraging customers to pay with cash or other non-credit card methods, a business owner can reduce the amount of credit card processing fees they pay.

Credit card payments are subject to chargebacks, which can result in lost revenue for the business owner. By encouraging customers to pay with cash or other non-credit card methods, a business owner can reduce their exposure to chargebacks.

Credit card transactions can be more complex to manage and record than cash transactions, as they involve multiple parties and systems. By encouraging customers to pay with cash or other non-credit card methods, a business owner can simplify their accounting processes.

Credit card payments can take several days to clear, which can result in delayed receipt of funds for the business owner. By encouraging customers to pay with cashor other non-credit card methods, a business owner can receive payments faster and improve their cash flow.

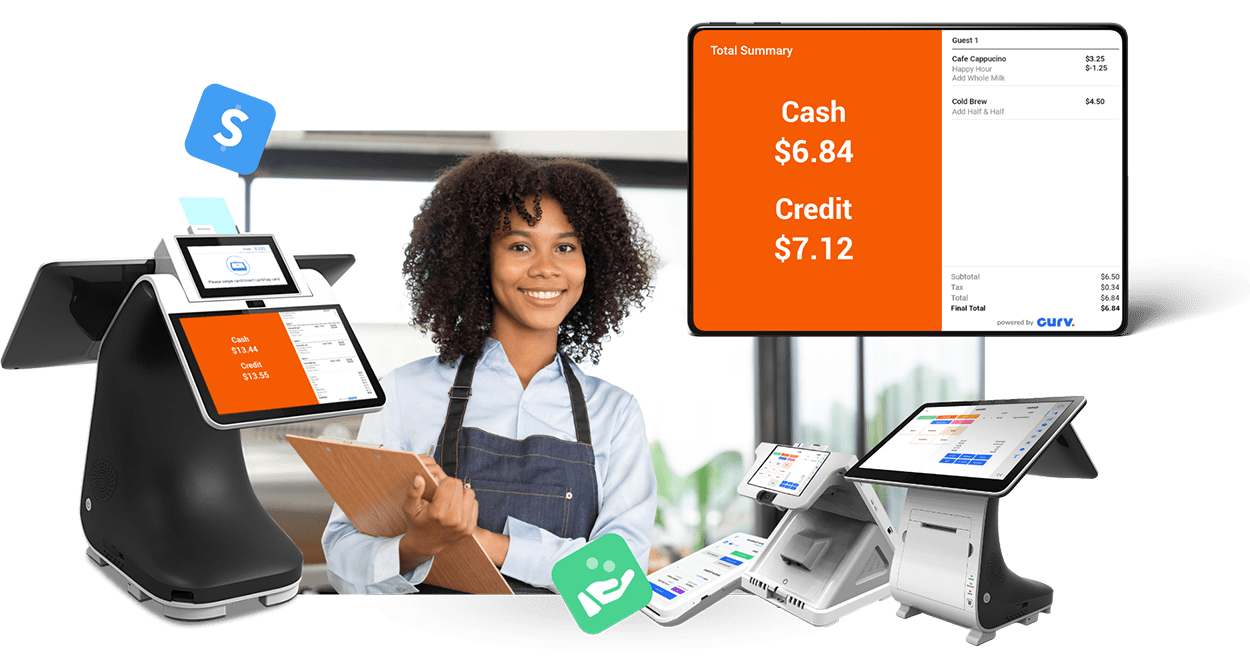

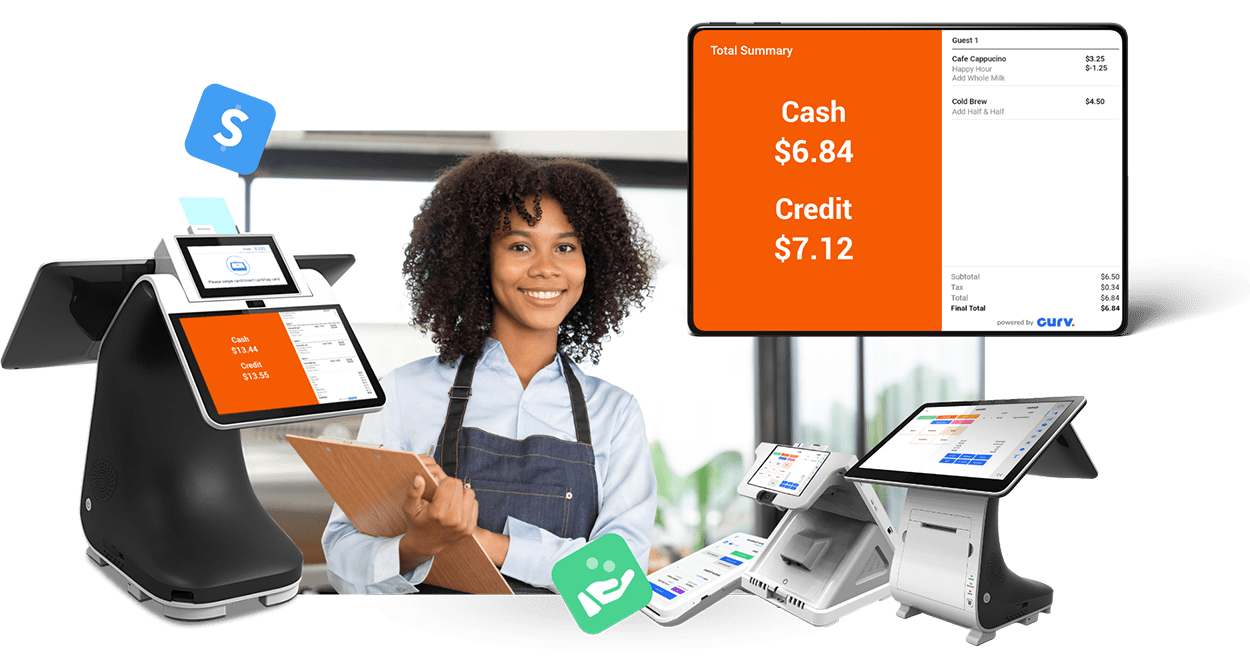

Cash discount is a reduction in the price of a product or service that is offered to customers who pay in cash. This incentivizes customers to pay in cash and helps the seller to avoid the cost of processing credit or debit card transactions.

Cash discount and surcharging are two different pricing strategies used by merchants to manage the cost of accepting different payment methods.

A cash discount is a reduction in the price of a product or service for customers who pay in cash, while a surcharge is an additional fee added to the regular price of a product or service for customers who pay with a credit or debit card.

In other words, cash discount incentivizes customers to pay in cash, while surcharging incentivizes customers to use other payment methods. The use of surcharging may be restricted or regulated in some jurisdictions, so merchants should call (855)368-1198 to confirm eligibility before implementing this pricing strategy.

To ensure that your cash discount pricing is compliant, you should follow these steps:

By following these steps, you can help ensure that your cash discount pricing is compliant with applicable laws and regulations.

Offering a cash discount can limit credit card processing fees for a business owner by encouraging customers to pay with cash or other non-credit card methods. This is beneficial because:

Overall, offering a cash discount can be a beneficial strategy for business owners who are looking to limit their credit card processing costs, improve their cash flow, and reduce their exposure to chargebacks.

Cash discounts can be beneficial for a variety of businesses, particularly those that have high volumes of transactions or low margins. Some examples of businesses that may benefit from offering a cash discount include:

It is important to note that the laws and regulations regarding cash discounts vary by jurisdiction, so it is important to research and understand the laws that apply in your area before implementing a cash discount.